Critical Illness A Life Policy for Today

A Life insurance policy with critical illness coverage provides a lump-sum payment to policyholders who survive one of the critical illnesses listed in the policy.

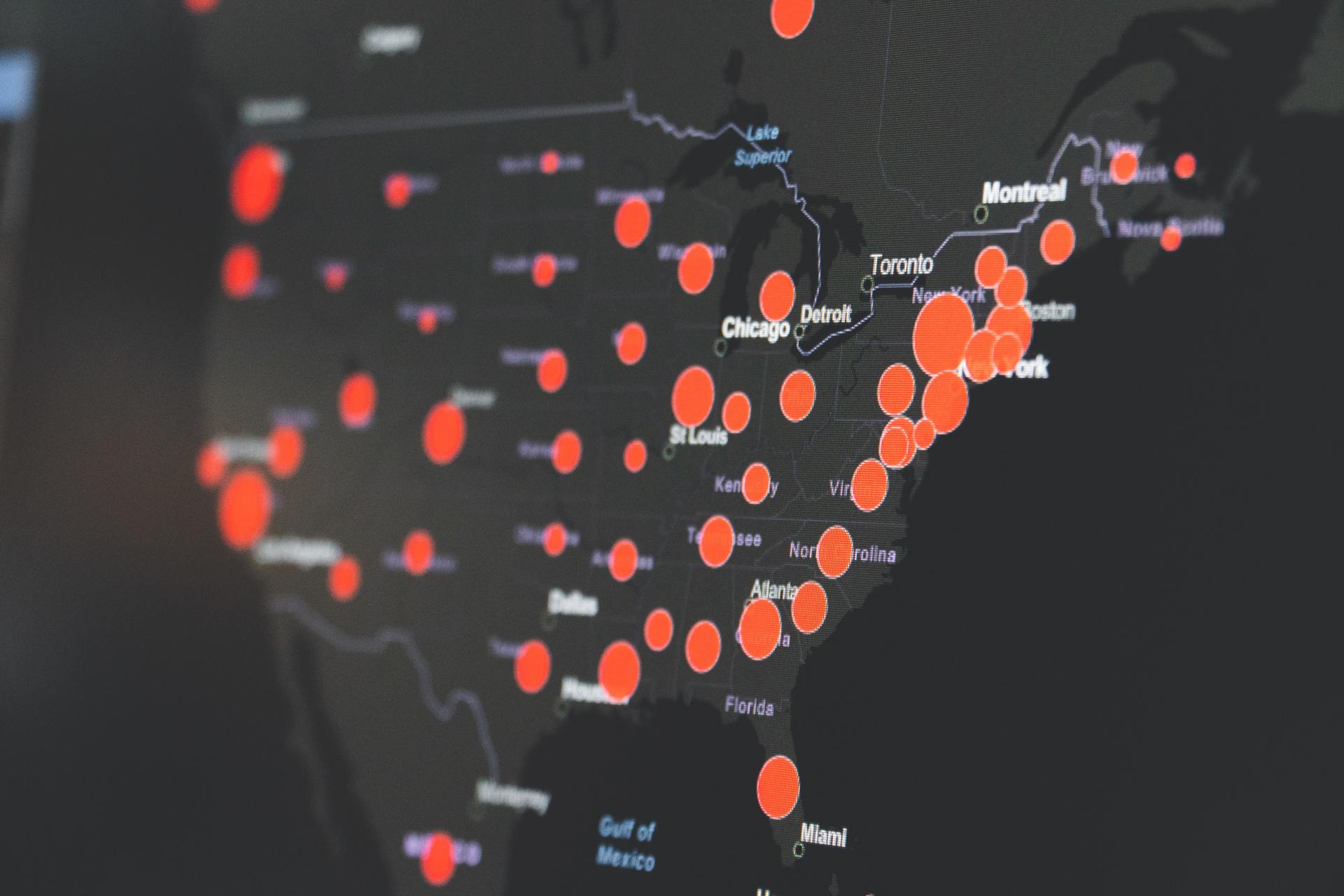

1 out of 3 Canadians will be diagnosed with some form of critical illness. Critical Illness is a defined disease or illness in a state in which death is possible or imminent.

The initial sign you are experiencing a critical illness is when you get rushed to the hospital and admitted into an intensive care unit and placed on life support because of complications of a severe illness that manifests itself in one or more of the following conditions;

1. Heart attack

2. Stroke

3. Respiratory complications

4. Infectious disease such as a rash

5. pneumonia

The common denominator in all these emergency conditions you are being hospitalized for awhile and if the prognosis worsens your hospital stay will increase and/or you succumb to your critical illness and die.

Critical illness insurance provides for a lump sum payment after a survival period beyond 30 days based upon the confirmed diagnosis of a listed critical illness in the policy a tax free benefits is paid to the survivor to help offset any costs associated with that specific illness during his/her recovery period.

There are up to a maximum of 26 defined illnesses that could be listed depending upon the type of policy you choose

Q: Who decides how much money is to be paid out?

A: The policy owner determines the lump sum tax free benefit that would be paid out.

Q: How is the monthly premium determined?

A: The premium is determined by several factors

• Age

• Gender

• Smoker

• Family history

• State of health

• Amount of lump sum

Q: What type of critical illnesses are covered in a policy in general?

A: The number of critical illnesses listed in a policy depends on the type of policy you purchase. In a comprehensive policy the following 26 illnesses would be covered in Canada;

• Acquired brain injury

• Aortic surgery

• Aplastic anemia

• Benign brain tumor

• Bacterial meningitis

• Blindness

• Cancer

• Coma

• Coronary artery bypass surgery

• Deafness

• Dementia, including Alzheimer's disease

• Heart attack and strokes

• Heart valve replacement or repair

• Kidney failure

• Loss of independent existence (LOIE)

• Loss of limbs

• Loss of speech

• Major organ transplant

• Major organ failure on a waiting list

• Motor neuron disease

• Multiple sclerosis

• Occupational HIV infection

• Paralysis

• Parkinson's disease and specified atypical parkinsonian disorders

• Severe burns

Cancer, Heart Attack and Stroke are the most frequent type of critical illness claims accounting for over 85% of all claims in Canada.

Cancer and Cardiac coverage are frequently combined together as a stand alone policy excluding all other coverages and issued without a medical examination you just have to answer a few yes/no questions. You must answer No to all questions if Yes the application is declined.

Critical illness is not a substitute or replacement for disability, rather a complimentary tax-free benefit that helps supplement a person’s disability income during those first few months of his/her recovery.

Critical illness benefits show up in various employee benefits plans in other instances as a term rider in a Life insurance and/or a stand alone policy.

Critical Illness Insurance and Long-term Care benefits

Critial Illness benefits are used to pay for Long term care facilities and home care assistance as well offering an alternative to Long-term Care insurance.

Very few insurers today provide for Long Term Care insurance which would virtually do the same thing as a critical illness policy whereupon the diagnosis of loss of independent living or dementia the insured would receive a tax-free lump sum payment to go towards the cost of staying at a long-term care facility or provide for home care assistance while remaining in your own home; hospitalization and associated medical expenses could be covered as well.

In the case of Homecare insurance the duration of the monthly benefit payments us dependent upon a deductible and premiums paidassociated with the benefits tied to the Long-term Care policy contract.

Traditional life insurance provider will include a compassionate clause within the policy that

will offer to payout up to 50% of the life insurance coverage if the insured is diagnosed as terminal and is expected to die within the same year.

Whole life policies that have dividend cash value and Universal life fund value policies also include a compassionate clause in additional permit tax-free cash withdrawals to support the life insured during a period of critical illness.

Other optional benefit available on Permanent Critical Illness Policies

• 50% return of premium if after a minimum of 10 years of age 65 whichever the greatest; the policy owner can cancel the policy and request a return of premium

• Policy paid up within 20 years

• Term conversion to a permanent policy

• Increase cover over the life of the policy

How long a critical illness policy lasts depends on the term purchased. It could be for 10, 20, 30, or life. The duration of the policy will have an impact on the premium paid. Also, a note about critical illness can only be purchased up to age 64 where for CAD 100,000 a lump sum benefit will cost a healthy 64-year-old male $4,000 in annual premium.

The risk of developing a chronic critical illness is real amongst all adult age groups. The Canadian Chronic Disease Surveillance Systems (CCDSS) estimates that 2.4 million Canadians aged 20+ will live with a diagnosed heart disease. The Canadian medical association journal reported back in 2015 1in2 Canadians are expected to develop cancer during their lifetime. CMAJ expects 225,000 new cases of cancer in 2020. The insurance industry has reported that 85% of all critical illness claims are shared between cancer and cardiovascular diseases.

Life insurance plays a major role in preparing chronic disease survivors for whatever come next Not only does Life insurance allow you to preserve your standard of living for your loved ones at a time of death by also including critical illness you will be paid directly a living benefit in the form of a tax-free lump sum payment of your choosing to allow yourself the time away from work in the event of a chronic critical illness to recover.

FAQ

Q: Have you heard that many critical illness insurance claims are being rejected, is this true?

A: As an industry, I would indicate that there may have been on occasion a false claim that was not paid however that would be the exception and not the rule. All legitimate claims are paid out in full. If you are uncertain about a particular plan, check with your independent broker before purchasing any form of life insurance policy

Q: Are there any thing I need to be aware of when considering critical illness insurance?

A: Before applying for insurance assess your current health status, your financial ability to withstand a critical illness, and consult with a licensed advisor to help you assess your initial approach to critical illness.

Q: Why should I consider critical illness insurance?

A: The financial burden placed on your family in the event of a critical illness.

Q: What is covered under a critical illness policy?

A: Not all policies carry the full list of critical illnesses, be sure to check before you apply for a particular policy.

Q: What is a good amount of critical illness coverage?

A: Only when you know your financial situation with proper consultation with an advisor you will determine what amount is appropriate.

Q: Does critical illness coverage pay off your mortgage?

A: Critical illness lump sum payment is designed to provide financial assistance while going through a recovery period if making mortgage payment during that period yes.

Q: Which is the best critical illness policy?

A: There is no such thing as the best policy, some policies are specialized and others cover the full list of critical illnesses and not all illnesses are considered critical and would not be covered under a policy.

In the final analysis critical illness insurance financially enables you to face and conquer any catastrophic storm that may or may not come your way and reaffirms the confidence within yourself and family moving on at that point in life.