Employee Financial Wellness and Its Impact on Canadian Businesses

No matter what business you’re in or how many people work for you, your employees are likely

among your key assets. Your business probably wouldn’t be successful without them. And your

business functions best when they are at their best.

Through research carried out in 2014, Manulife has established that there is a strong relationship

between personal financial wellness, physical and emotional health, and productivity. We are of

the view that to keep employees engaged, and to keep productivity optimal, employees need to

be physically and emotionally healthy, and they need to be financially well, too.

In 2015 Manulife commissioned Environics Research Group to survey 2,004 individuals to gain a

better understanding of Canadians’ financial wellness levels. The results were eye opening.

The survey showed that while 28% of respondents felt they had a high level of financial

wellness and just over one-quarter (27%) felt they had a medium level of financial wellness,

almost half (45%) identified themselves as having a low level of financial wellness. This alarming

statistic manifests itself in numerous ways, including a lack of retirement readiness, inadequate

financial protection in case of unforeseen events and high levels of money-related stress.

Digging deeper into the segment of respondents with a low level of financial wellness, nearly

half (45%) of them felt distracted at work because of financial worries. Our previous researchi

has identified that distracted employees, or employees who are not engaged in their work, have

lower rates of productivity, which can negatively affect business’ bottom line. This leads us to

believe that disengaged employees are also less attached to their organization and therefore

more likely to be lured away by other employers, which increases a company’s costs for

employee searches, hiring and training.

Financial support and education, well beyond retirement education, could go a long way toward

improving the financial wellness of your employees. That means helping employees holistically

– from savings to debt to insurance. For some employers, the workplace can be an ideal spot

to deliver the tools that allow employees to achieve improved financial wellness for themselves,

thereby becoming more engaged in their work and boosting the bottom line of the organization

they work for, too.

MANULIFE’S FINANCIAL WELLNESS STUDY – BENCHMARK 2015

In early July 2015 Environics Research Group surveyed 2,004 Canadians, 18 and over, asking them about six segments

of their financial life: budgeting, retirement, investments, debt, protection and stress. Respondents were equally split along gender lines, the mean age was 47, and quotas and weighting were used to ensure that results reflected the Canadian distribution in terms of age, gender and region.

The 2015 survey was designed as a benchmark and is intended to be repeated annually to create an informative index to track financial wellness over time.

What is Financial Wellness?

Financial wellness is not measured by the amount of money in a person’s investment accounts or the years they have left to pay off their mortgage. A person who has a high level of financial wellness is confident about a wide range of issues that make up their financial life, including budgeting, retirement plans, investments, debts and insurance.

It’s quite possible for a person to have a high income but a low level of financial wellness. It could be that these high earners aren’t planning for the future, they’re not working toward paying off their debts or they’re constantly worried about money.

Conversely, it’s quite possible for a person to have a lower income and a high level of financial wellness. A young person who is just starting out in their career, for instance, isn’t earning a high salary but can feel confident about their finances because they’ve educated themselves, asked for advice, created a workable budget and started saving for retirement.

Our survey found that financial wellness seems to have some momentum to it. If a person demonstrated a high level of financial wellness in one area they tended to have a high level of financial wellness in the other areas as well.

For instance, among the respondents who had an overall high level of financial wellness, 99% also scored well for budgeting, 61% scored well for retirement planning, 100% scored well for debt management and 76% scored well for stress management.

This shows that once a person has committed to addressing one aspect of their financial life, they will likely address the others as well, resulting in overall good financial health. Employers benefit from helping their employees get educated about finances and making that first step toward financial wellness because, as a result, employees will become less anxious about money and more engaged at work.

Benefits and consequences of high and low levels of financial wellness

The benefits of a high level of financial health can be both concrete and more abstract. A concrete benefit, for example, is having a well-funded retirement savings plan due to diligent budgeting and taking advantage of appropriate investment vehicles over a long time horizon. A related abstract benefit is feeling little to no stress about retirement.

Another concrete benefit is having few debts, an actionable plan to pay down debts or having manageable mortgage debt, which will one day result in outright home ownership. A related abstract benefit is, again, fewer financial worries and more overall confidence.

Consequences of a low level of financial wellness are, similarly, concrete and abstract. Poor budgeting and investing, among other factors, can lead to a poorly funded retirement savings plan and the accompanying stress. Inadequate insurance coverage can mean financial hardship if an accident, death or disability occurs, as well as the accompanying worry about such unforeseen events happening.

Another consequence of having a low level of financial wellness is that it can be a self-fulfilling prophesy. Just as people who were found to have high levels of financial wellness tended to score well across all survey categories, people who have low levels of financial wellness tended to score poorly across most categories.

According to the survey, 73% of respondents with an overall low level of financial health also scored poorly for retirement planning, and only 27% of people with a low level of financial health had a medium score for retirement planning. No one with an overall low level of financial health scored well when it came to retirement planning. It’s not surprising that 85% of respondents who have an overall low level of financial health also ranked “poorly” for insurance protection and 63% indicated they had high levels of finance-related stress in their lives. Based on this, that stress can lead to anxiety and poor mental health, which takes a toll at home and in the workplace, through disengagement and lack of productivity.

Snapshots

The Environics survey allows us to take a focused look at who has a high level of financial wellness and who has a low level of financial wellness across a broad spectrum of the Canadian population, and to zero in on Canadian workers.

For the first time in history, our working population includes five generations of Canadians, ranging from Generation Z to Baby Boomers. These people are at dramatically different stages in their lives and their careers, with different priorities at the top of their lists, and it can be challenging for a workplace to cater to everyone’s financial needs.

AGES AND STAGES

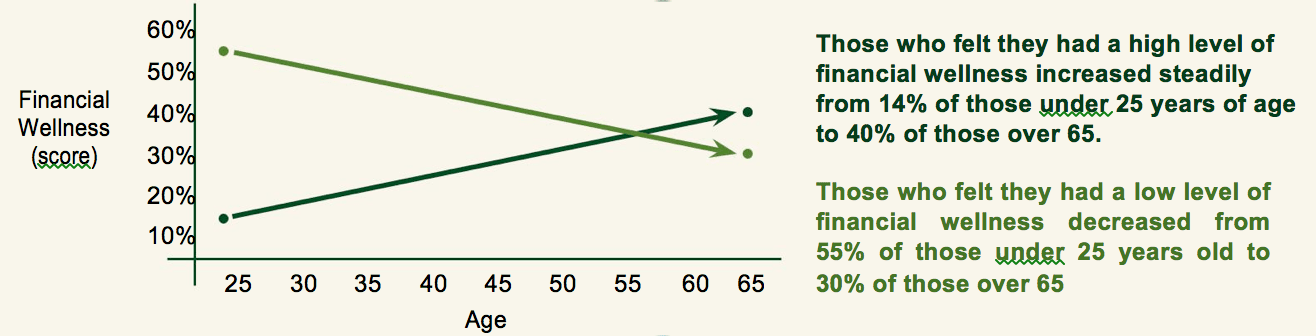

The differences among respondents become evident when reviewing how people of various ages and life stages tend to feel about their financial wellness. Those who felt they had a high level of financial wellness increased steadily from 14% of those under 25 years of age to 40% of those over 65. And those who felt they had a low level of financial wellness decreased from 55% among those under 25 years old to 30% for those over 65. These progressions are promising because they show that as people age they become more financially secure due to factors such as increased salaries, more financial education, decreased debt and better retirement readiness. The progressions are also logical: It would be unrealistic to expect a 22-year-old, just starting out in their career and independent financial life, to have the same level of financial wellness as a 66-year-old does. In fact, it’s likely that the same 22-year-old who identifies herself as having a low level of financial wellness will show that she has a higher level of financial wellness by the time she reaches her 60s.

We are of the view that one of the best ways to help young people who self-identify as having a low level of financial wellness is to give them access to a broad financial education. If they become adept at managing savings, debt, investments and insurance, they will be in a better financial position when it comes to saving for retirement as well.

Following the pattern outlined above, when surveyed specifically about financial planning and saving for retirement, the survey found that the youngest respondents were least likely (8%) to agree with the statement: I’m saving on a regular basis and I’m on track to reach my retirement goal. Among respondents over age 65, 33% agreed. It’s a positive trend to see growth in the number of people feeling secure about their retirement, but younger people have the benefit of longevity and compound interest to make their savings grow, and should be advised to get more involved in long-term financial planning as soon as they enter the workforce. It’s also important for those in the older cohorts to not be complacent about their financial wellbeing. The research showed that people tend to have higher levels of financial wellness as they mature, but unexpected life circumstances – such as divorce or a job loss – could reverse that.

Lifestyle also had a bearing, as respondents who were married or co-habiting were more than twice as likely (23%) to be saving and staying on track for retirement as their single counterparts (11%). Also noteworthy was that respondents who owned their home were more than twice as likely (26%) to say they were saving and on track for retirement as people who rented their homes (11%).

GENDER

Across the board, the survey found that men self-identified as having higher levels of financial wellness than women. However, past research conducted by Environics shows that men tend to report higher levels of confidence than women, so their answers need to be viewed against that background. Overall, a high level of financial wellness was indicated by 32% of men, versus 25% of women.

On the topic of financial knowledge, 32% of men said their level of savings and investment knowledge was beginner, versus 50% of women. When asked how ready they were to improve their financial situation, slightly more women than men said “very.” And when it comes to confidence, 74% of women agreed that they would “like to be more confident about making financial decisions,” while only 66% of men had the same response.

Additionally, 74% of women agreed that they worry about their financial situation and 34% of them agreed that financial worries caused them stress at work, versus only 66% of men worrying about their situation and 31% of them saying it affects them at work.

These findings lead us to believe that all employees would benefit from improving their financial knowledge, in the workplace or elsewhere. Women may be more receptive to the offer while men may require some persuasion to recognize how additional education and support could benefit them.

GEOGRPAHY

Across the country, the most regional differences were seen when comparing Quebec to the five other regions (Atlantic Canada, Ontario, Manitoba/Saskatchewan, Alberta and British Columbia). The Quebec residents who were surveyed were least likely to indicate they felt finance-related stress (51% scored “good” on the survey’s stress index, versus 47% for all respondents) and they indicated they had higher levels of financial wellness related to debt, with 88% scoring “good” on the survey’s debt index, versus 82% for all respondents. However, respondents in Quebec scored second lowest in the retirement index, with only 16% feeling retirement ready, versus 20% for the rest of the country.

Another outlier was British Columbia, where the cost of housing in Vancouver and the Lower Mainland has become increasingly unaffordable in recent years. Only 22% of British Columbians surveyed indicated a high overall level of financial wellness (versus 28% for the country as a whole) and 24% scored “poorly” on the debt index, compared to 18% for all respondents. Specifically, the survey found that only 32% of respondents in British Columbia indicated that they have debt and are able to pay it down, compared to 40% of all respondents.

Finance related stress Financial wellness related to debt

51% 88%

of Quebecers scored “good” of Quebecers scored “good"

on the survey's

stress index on the survey's debt index

47% 82%

of all respondents

scored “good” of all respondents scored “good”

on the survey's stress index on the survey's debt index

INDUSTRY

More financial support and education would benefit all employees, but the survey found that respondents who had low levels of financial wellness tended to work in trade (retail and wholesale) (12%), accommodation and food services (8%), business, building and other support services (7%) and transportation, warehousing and utilities (6%). Respondents who indicated they had a high level of financial wellness were more likely to work in professional, scientific and technical services (12%), manufacturing (10%) and education (10%). However, no one sector stood out as having a high level of financial wellness. Even within finance, insurance and real estate, where one could reasonably expect to find well-educated, financially aware workers, 36% indicated they had a low level of financial wellness. The survey also found that people who had a high level of financial wellness were more likely to be managers (26%) or professionals (25%).

ADDITIONAL CHARACTERISTICS

The survey revealed some additional, and troubling, insights about the people who

identified themselves as having a low level of financial wellness.

People with a low level of financial wellness indicated that they are more focused

on short-term issues than long-term ones.

For example, the top financial priority

for the 45% of respondents who were found to have poor financial wellness was

paying off debt, with 58% of people in this cohort citing that as their main focus.

That compares with only 26% of people with a high level of financial wellness. It’s

undeniable that paying off debt should be a priority, but for this segment it seems

to be taking precedence over big-picture plans, such as saving for retirement –

which was a priority for only 14% of these respondents.

It was also noteworthy that among all survey respondents, saving for short-term

needs (such as buying a car or funding a vacation) was the second-highest priority,

after paying down debt, and planning for retirement ranked sixth.

People with a low level of financial wellness also indicated that creating an

emergency fund was high on their list of priorities, with 33% of people working

toward that goal versus 12% of the people who were more financially secure.

On the other hand, people with a high level of financial wellness indicated that

their top two financial priorities: ensuring that their savings are wisely invested

(45%) and minimizing the income tax that they pay every year (35%).

People with a low level of financial wellness also seemed less interested in

educating themselves about finances than did their peers with a higher level

of financial wellness. According to the survey, only 12% of people with poor

financial wellness visit investment-related websites, versus 34% of people who are

financially healthier and 22% of the respondents overall.

Finally, the study revealed a correlation between do-it-yourself investors and

people with a low level of financial wellness. Specifically, 66% of people with poor

financial health agreed with the statement “I prefer to manage my finances myself

and not rely on an advisor.” Only 48% of the people with a high level of financial

wellness indicated they felt the same way, suggesting that having guidance and

advice are linked to financial security.

Of respondents with poor

financial wellness:

58%

said their top financial priority was paying off debt

14%

said saving for retirement was a top priority

Deep dive into financial wellness

The Environics Research survey unearthed a wealth of information about Canadians’ habits related to various aspects of their financial lives: budgeting, retirement, investments, debt, insurance and stress.

BUDGETING

The good news is that fully 87% of respondents said they have a budget, which simply means

that they keep track of income and expenses. Not surprisingly, more people with a high level of

financial wellness have a budget (95%) versus those with a low level of financial wellness (81%).

However, having a budget isn’t the same as sticking to it. While 86% of people agreed that they

usually spend within their means, only 73% of those with a low level of financial wellness were in

that camp, versus 99% of people with sound financial health. In terms of age, people in the older

cohorts indicated they would be more likely to stick to their budget: 84% of people 35 to 44 years

old said they spend within their means, while the same was true for 86% of people 45 to 54,

and 89% of people 55 to 64. People 65 and older were the most likely to stick to their budget,

probably because they’re most likely to be on a fixed income, with 93% reporting that they spend

within their means.

RETIREMENT

Canadians are living longer than ever before. The current life

expectancy is 78.8 years for men and 83.3 years for women. But

people who reach age 65 tend to have even greater longevity:

men can expect to live another 18.5 years, to age 83.5, and

women can expect to live another 21.6 years, to 87.6 years.

That means people can spend more years in retirement –

sometimes more years than they spent in the workforce. This is

why retirement needs to be a top priority for all Canadians, even

though the study found that retirement is still more than 10

years away for two-thirds of non-retired respondents.

Therefore, it’s troubling to find that 35% of those aged 25-64

are not saving for retirement. This finding is inextricably linked to

the fact that more people said they were saving for short-term

goals and paying down debt than saving for their retirement

years.

Overall, only 19% of people surveyed said they were saving on a

regular basis and were confident about meeting their retirement

goals. And 44% either said they were not saving on a regular

basis or didn’t know whether they were on track to meet their

retirement goals. At almost 50% of respondents, this is a very

large group of people who might not have a secure retirement

ahead of them.

The largest cohort of people who indicated they were not

saving – at 50% – was people under 25 years of age. When

asked for the main reason why they’re not saving, 43%

of people under 25 indicated that it was too early to start

saving. However, today’s young workers can benefit greatly

from understanding that they have longevity on their side.

If someone invested $5,000 a year from age 25 to 40, and

then didn’t add to their investment account for another 25

years, assuming a 5% rate of return, they would have about

$130,000 more money at age 65 than if they started saving the

same amount when they were 40.

19%

saving on a regular basis and

confident about meeting their

retirement goals

INVESTMENTS

When it came to investments, 67% of survey respondents agreed

that their savings were invested in a way that was right for them

– with 21% saying “definitely” and 46% saying “I think so.”

But 11% didn’t know if their savings were invested correctly

for them and almost one-quarter of respondents (22%) had no

savings at all.

People who work in finance, insurance and real estate showed

the most confidence in how their savings were invested (45%),

and people in wholesale or retail trade were most likely to say

they had no savings (35%).

22%

of Canadians had no

savings at all

DEBT

While it seems to be universally frowned upon, not all debt is bad.

Mortgage debt, for instance, which is paid down monthly until

outright home ownership is achieved, usually after the property

has appreciated in value, is good debt. Car loan debt is neutral,

with the understanding that cars depreciate over the years. And

credit card debt – often coupled with double-digit interest rates

– is not good debt.

Overall, 56% of Canadians have some kind of debt, whether it

be good, bad or neutral. Fewer people who identified themselves

as having a high level of financial wellness have debt than people

with a low level of financial wellness (37% versus 69%), and

people in Atlantic Canada (63%) were most likely to have debt.

Among those with debt, 71% said they were able to make their

payments with no difficulty. The other 29% of the population

either indicated they had difficulty making their payments or didn’t

know if they could. That means, in total, 16% of Canadians (29%

of 56% of people with debt) are not managing their debt well and

likely feeling stress related to that.

To further illustrate poor debt management skills uncovered by the

survey, 49% of respondents who are struggling to pay their debt

said that in the past 12 months they have not paid their credit card

balance in full every month, 46% said they were not able to make

some debt payments on time and 46% said they were not able to

reduce their overall debt.

46%

said they were not able to

make debt payments on time

46%

said they were not able to

reduce their overall debt

PROTECTION

Canadians are still not creating enough financial protection for

themselves and their families, which can lead to stress in the

short term and financial hardship if the unexpected were to

happen.

Fully 43% of Canadians said they were not financially well, or

didn’t know whether they were financially well, if they, their

spouse or dependents were to die. Additionally, 40% responded

the same way when asked whether they were prepared if they,

their spouse or dependents developed a serious illness and 43%

responded the same way about a disability. This means that

almost half (42%) of Canadians are living precariously, possibly

just one diagnosis or accident away from financial insecurity.

Once again, an overall high level of financial wellness was most

closely correlated with feeling prepared for the unexpected.

People with a high level of financial wellness were more likely

to say they would be prepared in case of death (68%), serious

illness (57%) or disability (53%) than people with a low level of

financial wellness, who scored 12%, 6% and 6% respectively,

for the same questions.

More than half of survey respondents (56%) do not have a will,

and 66% do not have a power of attorney. Being unprepared

for their own end-of-life decisions could be stressful for these

individuals and will most likely have a negative impact on those

closest to them.

56%

of the population do

not have a will

43%

of Canadians said they

were not

financially well,

or didn't know whether

they were financially well,

if they, their spouse or

dependents were to die

STRESS

Feeling pressure and stress over financial matters is very common.

Seventy per cent of people surveyed agreed that they worry

about their financial situation often or sometimes, and 33% of

overall respondents said that worry distracts them at work.

Among people who had a low level of financial wellness, 85%

worried about money often or sometimes, which was almost

twice as many as the people who had good financial health. And

almost half of the people with poor financial health (45%) said

that their financial concerns distracted them at work, versus only

17% of people with a high level of financial wellness.

When people are able to take control of all aspects of their financial

lives – not just retirement planning – their finance-related stress

will decrease. And by improving their overall financial health, their

retirement prospects are likely to be enhanced as well.

45%

of the financially unwell said

that their financial concerns

distracted them at work

Financial advice

The value of good financial advice from a credible source is both tangible and

intangible. The tangible aspect is witnessing the funds build up in an investment

account after acting on the advice of a financial advisor. The intangible aspect is

the feeling of security a person can gain from knowing they have a professional

on their side. For example, a financial advisor, which can be any practicing

professional who provides advice and information on financial services, such as

mortgages, loans, insurance, mutual funds and more. We believe this feeling of

security can positively influence many aspects of a person’s life, including their

career choices, their attitude at work and the values they pass on to their children.

A person doesn’t need to have a high net worth to take advantage of an advisor’s

knowledge. According to the Environics Research survey, 41% of Canadians said

they had some sort of financial advisor and 59% said they prefer to manage their

finances themselves and not rely on an advisor.

When we look at the level of financial wellness among survey respondents, we see

a sharp divide between those who use financial advisors and those who don’t. Just

over half (53%) of the respondents who identified themselves as having a high

level of financial wellness said they usually consult a professional advisor before

making a financial move. But just 18% of people with poor financial health said

they did the same.

Financially well

53%

consult an advisor

Financially unwell

18% consult an advisor

Financial health and business

An employee’s personal financial heath definitely has an impact on their workplace

– especially if the employee has a low level of financial wellness, inevitably

accompanied by stress.

The survey revealed that 42% of working Canadians overall say they are distracted

at work because they are worrying about money. And previous Manulife research

has shown that people struggling with their personal finances felt they were 16%

less productive on the job.i

For an employee earning $50,000 a year, that equates

to $8,000 in salary paid but for which the work performed was sub-optimal. This

number grows with each additional employee who finds himself in the same

situation, increasing the impact on their employer’s bottom line.

42%

of working

Canadians overall

say they are

distracted at work

because they are

worrying about

money

The financially unprepared

say they are 16%

less productive on

the jobi

Employer's role

On a positive note, the survey found that nearly three-quarters (74%) of Canadians surveyed felt they were ready to take

steps to improve their financial situation. Even among people with a low level of financial wellness, the desire to improve was

high, at 69%. The desire to improve was even higher (79%) among those whose financial health was already good, a finding

that points to the importance of viewing a plan member's financial wellness holistically, and working to engage them towards

continual improvement.

Employers will benefit from being able to accurately assess their employees’ level of financial wellness so that they can be

effective in helping support their employees and positively impact their workplace engagement. And because financial

wellness encompasses a broad spectrum of issues – not just having a retirement plan or workplace benefits – it’s best to work

with a provider who understands how employees feel and can offer relevant solutions to specific challenges.

How employers can benefit from supporting employees' financial wellness

When people are offered, and take advantage of, the tools to become more financially stable they can become less anxious,

more engaged in their work and better workplace contributors. They can also pass these positive attitudes on to their

colleagues, creating a chain reaction with far-reaching ripple effects.

Tools, such as retirement savings plans, insurance products, access to advice and education, do not need to be delivered in

the workplace, but when they are, employees typically recognize that their employer is actively supporting them. Over the

long term, employers who are seen as positively contributing to their employees’ financial wellness will develop a reputation

for supporting employees and will improve their employer brand, which will help them retain valuable employees and gain an

upper hand in the competition for top talent.

Get a quote now!